Transfer Pricing

Transfer Pricing documentation is becoming increasingly important to meet legal documentation requirements and to be prepared for questions from the Tax Authorities. How do you develop the documentation as efficiently as possible and how do you keep it up-to-date?

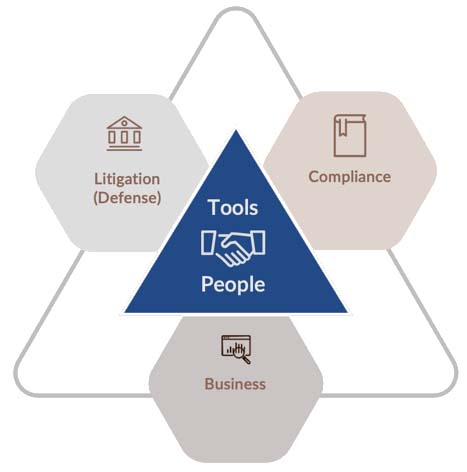

Our aim is to enhance the compliance and litigation process for transfer pricing by adopting a pragmatic and efficient approach. We strive to achieve this by harnessing a harmonious blend of human expertise and intelligent software solutions. By leveraging the strengths of both, we can optimize every aspect of transfer pricing, ensuring accuracy, effectiveness, and streamlined operations. This approach enables us to navigate the complexities of transfer pricing with precision and agility, ultimately leading to improved outcomes and enhanced compliance.

Modular approach

To meet transfer pricing documentation requirements, we have developed a thorough modular approach. Ex Nihilo offers various solutions ranging from a review of documentation to identify potential risks, shortcomings, do’s and don’ts to complete outsourcing of your documentation. Our modular approach allows you to prepare parts of the documentation yourself, optional with our software tools, under the guidance of our specialists.

In any case, fully outsourced to largely insourced, we compile, update and review transfer pricing documentation not only from a compliance perspective, but also from a risk perspective. We minimize this risk by supporting companies in the preparation and implementation of a Value Chain Analysis, in which the business processes of your company are consistent with the tax rules of the various countries.

With our broad experience in Supply Chain Analysis and Value Chain Analysis we are the perfect partner in the field of Transfer Pricing documentation services.

Determine your working method

We do it for you

We draft the TP documentation for you, based on interview and received documentation. The draft documentation will be reviewed by you. After the review, the final documentation is provided.

We do it with you

You prepare the company information*. We provide you with the template and guidance. We review this information. We perform the functional and economic analysis, including benchmarks.

You do it yourself

We provide you with the template and software (optional) and guidance (optional). You draft the TP documentation yourself. We review te documentation and provide a memo describing any non-compliance and/or risks. Benchmarks are optional.

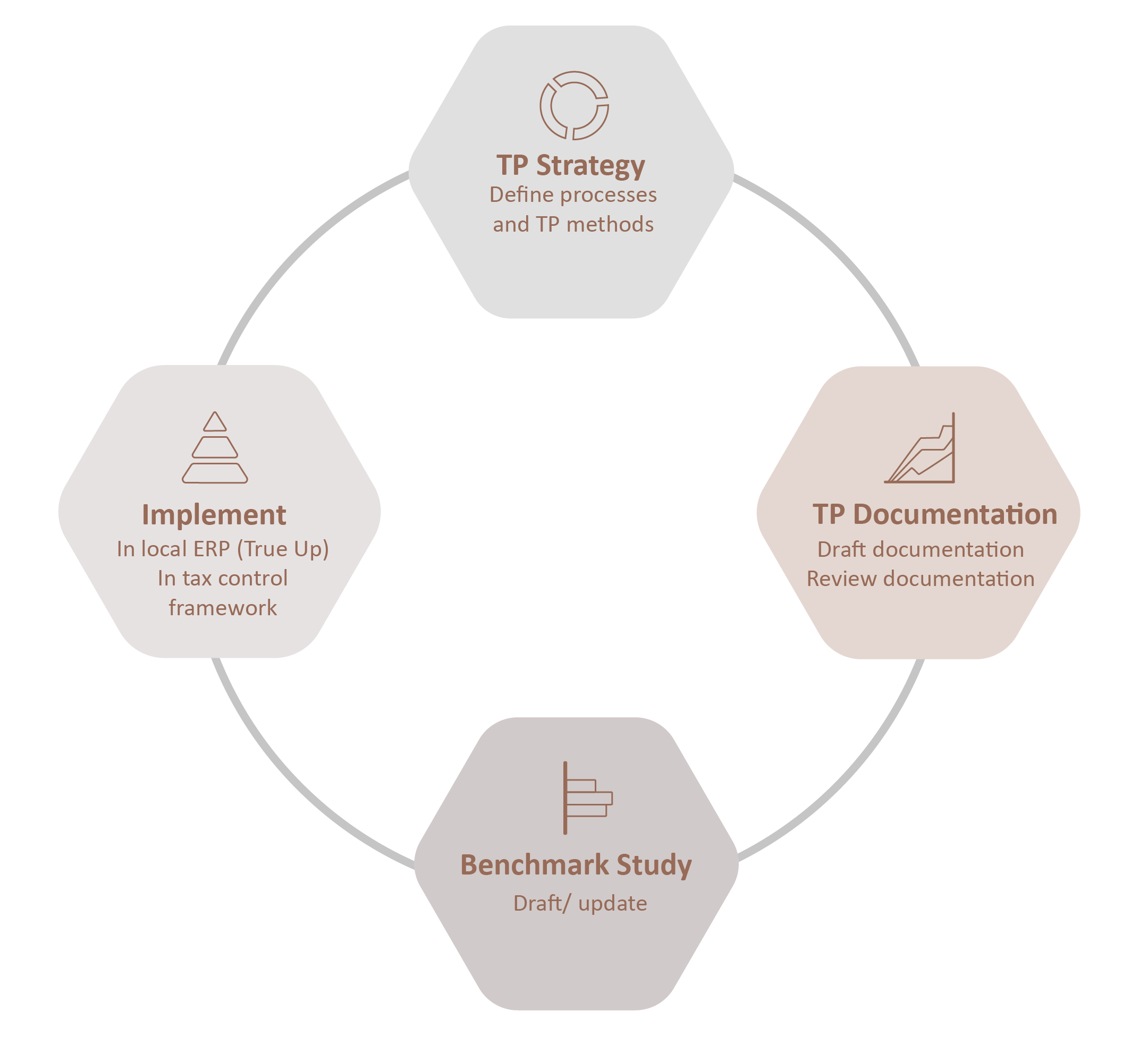

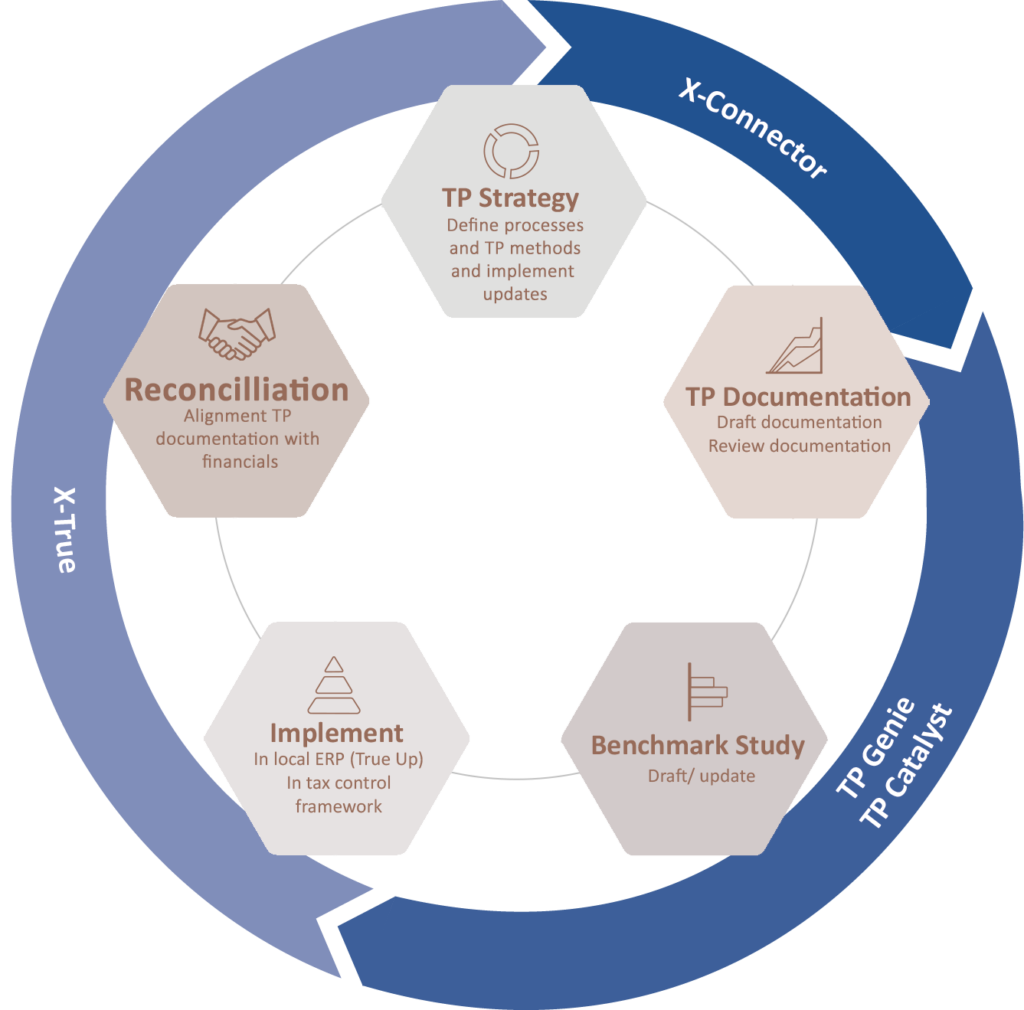

Transfer pricing Cycle

Transfer pricing documentation is an important part of being compliant with local rules and regulations. Being fully compliant starts with defining the transfer pricing strategy and ends with the implementation of the defined transfer pricing methods and ensuring the actual results fall within the defined (interquartile) range.

Based on your current structure and processes we define and develop a strategy which strengthens the efficiency and tax control framework.

The information included in your transfer pricing documentation needs to be aligned with the (f)actual situation, realized result on intercompany transactions need to be aligned with the defined arms’ length price described in the documentation.

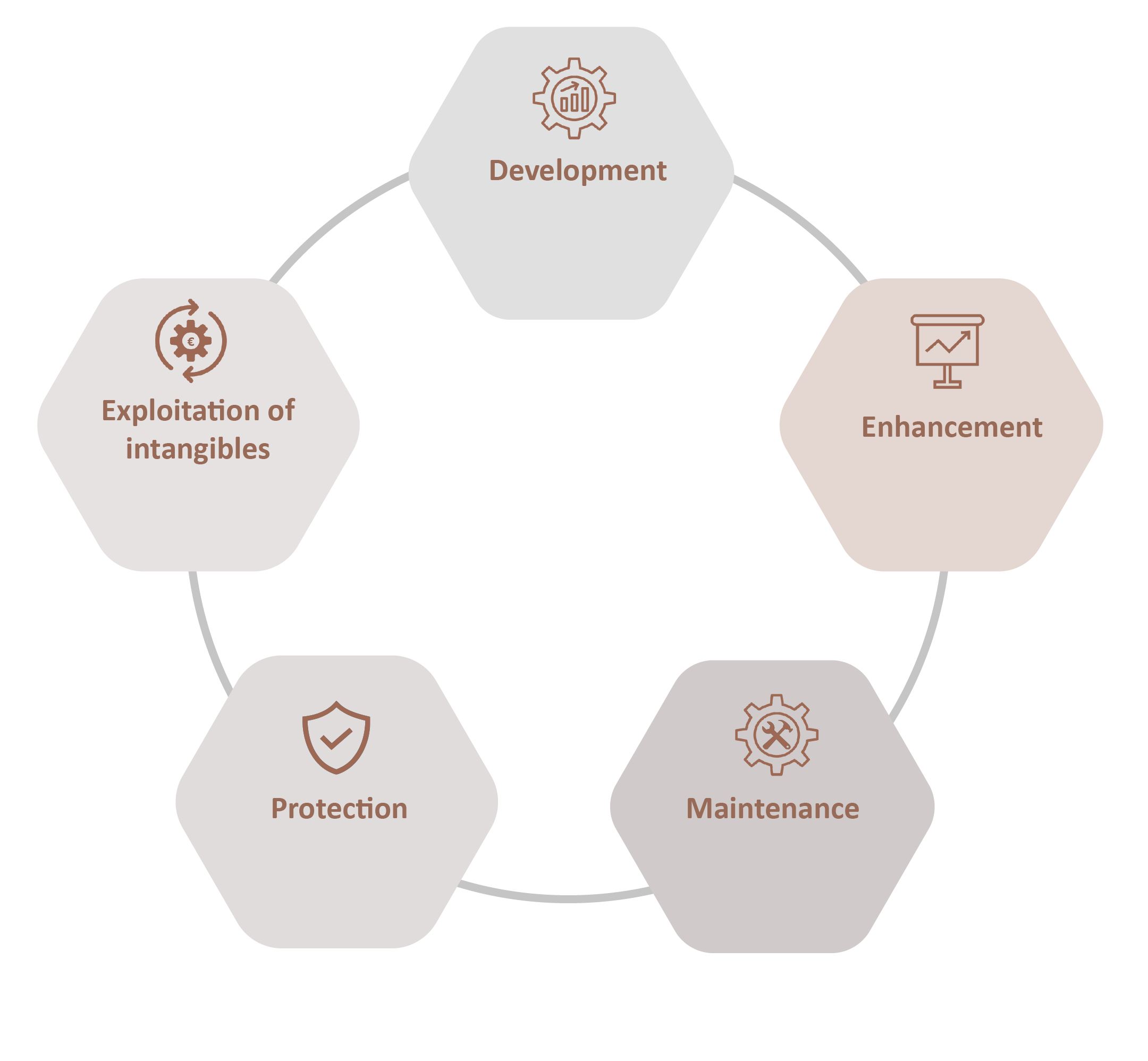

DEMPE

Intangibles are of critical significance for multinational enterprises from a business, operational and tax perspective.

Under the arm’s length principle, each member of the multinational enterprise group should receive arm’s length compensation for the functions performed, assets used, and risks assumed.

In cases involving intangibles, this includes functions related to the Development, Enhancement, Maintenance, Protection, and Exploitation of intangibles (DEMPE). DEMPE is a analysis designed to ensure that allocation of the returns from the exploitation of intangibles, and also allocation of costs related to intangibles, is at arms’ length.

Transfer Pricing automation

With the vast amount of data transfer pricing automation is crucial for businesses to ensure compliance and mitigate risks. It streamlines the complex process of allocating profits and pricing transactions between related entities, reducing human error and increasing accuracy. Automation also enhances efficiency by saving time and resources, allowing companies to focus on strategic decision-making. Ultimately, it promotes transparency and consistency, enabling businesses to navigate international tax regulations with confidence.

That Is why Ex Nihilo is offering Transfer Pricing software solutions in combination with its services.

X-True

Provides actionable insight in the status of the compliance and reconciliation of the actual result and defined interquartile range of any intercompany transaction. It enables scenarioanalysis and the possibility to adjust the intercompany pricing in your ERP system. This all without the need for human input. Data is retrieved directly from the data source and transformed to information. It generates a PDF document stating the data(set) used, calculation performed, adjustments made, reconciliation and the full audit trail.

TP-Genie

Helps you to efficiently create, update and manage your transfer pricing documentation, including Master and Local file, Intercompany Agreements, Benchmarking and Country-by-Country Reporting.

TPGenie also assists you with TP planning, risk management and control. TPGenie is BEPS Action 13 compliant. We provide you with licenses and full support; from implementation to training your employees.

We are a proud silver partner of TPGenie.

X-Connector

The transfer pricing automation tool seamlessly integrates with diverse data sources, facilitating data cleansing, enrichment, and standardization. It ensures that data is readily available in the desired format for optimal utilization. The tool offers a user-friendly interface for convenient customization and adjustments. Furthermore, it incorporates state-of-the-art security measures, safeguarding sensitive information with the latest industry standards.

TP Catalyst

Ex Nihilo makes use of TP Catalyst for benchmark studies. This offers several advantages. Firstly, TP Catalyst provides access to a vast database of comparable transactions, enabling businesses to identify relevant industry benchmarks quickly and accurately.

Secondly, TP Catalyst’s advanced analytics capabilities allow for in-depth analysis of benchmark data, helping businesses make informed decisions regarding intercompany pricing. The software can perform complex statistical analyses and generate comprehensive reports, providing valuable insights and supporting documentation for transfer pricing compliance.

Overall, TP Catalyst empowers businesses to conduct robust and reliable benchmark studies, enhancing the accuracy and defensibility of their transfer pricing positions.

Request a free online meeting

We would be delighted to provide you with more information and offer a personalized session tailored to your specific needs. Our team of experts is ready to assist you in exploring the features and benefits that our software as a service can bring to your business. Get in touch today to schedule your session and discover how we can assist mitigating your risk!

We will be in contact soon!